Newton Protocol & NEWT Transparency Report

Exhibits & References

Supporting documents, links, or exhibits that supplement this disclosure can be found here:

- Exhibit A: On-Chain Addresses

- Exhibit B: Audit Reports and Code Repositories

- Exhibit C: Legal Disclosures and Risks

- Exhibit D: Financial Policies

EXHIBIT A: ONCHAIN ADDRESSES

Community Rewards - Wallet

- 0x2F395C5eCD2983CBa53bD5eddDc0684a415713fb

Validator Rewards - Wallet

- 0xBc8E97E67db5632AC779EA132963023FFE49aACc

Liquidity Support - Wallet

- 0x26580d3b95E6B260E80D44d73a3103ef8EaA23d4

Onchain Ecosystem Growth Fund - Wallet

- 0x00680Ce5C6b2Fa6845037171e1d84d56Abc9c341

Onchain Ecosystem Development Fund - Wallet

- 0x8cC2d3f139EB6d5b6912b3218f7a0f63A6556C8E

Onchain Foundation Treasury - Wallets

- 0x32556362Ad2b9bFf71C8c666CD061eE4A38206df

- 0x367AE7E743DC57d883be98596e06E227b34670d0

- 0x1Bb33De17228DEb0a941421903A1B1882C69bdc4

- 0xf6d764335A0234007C3D853B728a0a264cb5b456

- 0x564A4Ef4CB21281A61cD6640Fb9be9F1da989cac

- 0x0B5bDB8CAFd87A60DCA8E293c59e7b3282AF0996

- 0xA3F0F514C3509894f2E7E23ec992b269a6afEd66

- 0x1d12F7a0a1B5E981a8Db7f1822c61d263387E19F

- 0x03242e43310926019d29b100F744341DFafcbEc2

- 0x48fb11f734Ef03DCC3CCD3685CEa12e2d38EcAc4

- 0xee40edC24B449ab6D06cEb9E15F530a4Eae58501

- 0xb936B5c999ca001C0F8c0434f3b53b916548f69D

- 0xf5D8b38c9b3E6A74DE026663b5b5BdF83D963129

- 0x01F3Bceb4C44a9F465d881Cc107778903478582a

- 0xc7857dB7Ce83Fc20CC95B180D2EF702de7dF3D92

- 0x6c0568F73015229C7cbc06E04990ee927ddBB6d1

- 0x297CE0372d5190B76FB8fF173243F3F1C49C30f3

- 0xfc8dB54854d51102dbdb59C7F54C132F1478C52f

- 0xa2a30aDa9d79e572022955Cc72BE68ec43D832E5

- 0x9fE220b961c46FbA90fBfB087FA89adf746E75b6

- 0x75b05Ce57Cb96385C668205D227f6E5E1E94Af48

- 0xbB282E105880c3e445C6185210e9b0475532dBe8

- 0xcBDAbe3723c57e5443752E0dFC06766C92F1f219

- 0x64Fb97a89D21933aA3a7dB9Ce981942Cf9b1a554

- 0x1Ee3caB22DDa2a38536A67BcF928b3Fe208B3730

- 0x04F1365cD2cb04AD8Daaf18092f9D65d469c9A82

- 0x05e39a3662D867C2eAa2e465737475F2F84F8B95

- 0xC001ff4cF7bbc10c87c913d7407047E56EB3e60e

- 0x04E337035F06b6756e8A327B4a2ab12ca91170ef

- 0x4C891626A68f237dA89dC7D17e3f5aD9ebb4Bd73

- 0xa684Ce92D2fCBFfCeae40A9DADdED026CcefAE85

- 0x7CE9909eD4DC00F866D11645876538ce1E13262c

- 0x1c39d55C3c8cC5Cd92E61a5396d1723706cb07D0

Early Backers - Wallets

- 0xA752e4277d68d964BD277f8d760959cb693e5630

- 0xCe4B2104c6584808f8Ef9aa4A8fa7f462BBC525c

- 0x948911735550b13Dd7f562f87C3A8a2d6f4a6Ff0

- 0x6a406e88880fB1F5ea1459A4E208b31f80CCE33A

- 0xaF1ed29c5498ef5dc647a2fF2894112cFb4432B6

- 0x0aB0f464274f653035912f33Fac6f50fB55DE8DA

- 0x0aC30b5515d8361b47172c0CfB4e016fE60A9ED2

- 0xcCC4122c4230C7b60B677e1C5d06442Ec5262360

- 0x5775f2c7E04AA0765a019b0733E6fA46819aE056

- 0x89Ed7CdACECcD242E8F47B8584D4494df53C332d

- 0x76CD9a1f19C9D5A72B121eE524330740240454Ca

- 0xC25FA8AECeE9b6E411BCd8689C2Ed56B055EDCca

- 0x7f34AB9388119873E205461655fFfF721a5A2eC8

- 0x093621F1dE361D17dC5F32eAd7Bc257cED915E87

- 0x21ddF3b6dc2c26f47fCA509f8C18959e97b21152

- 0x0b98b1069d7160d90F8a398c61b3c34e7F08EC49

- 0x3A3DC70F0584005ff48f45B569671De10B9c9FE2

- 0xf682fE640Ec249Ba0f785A4639DB2E0fE2D38f2A

- 0xf8D8100581548be6F2EAD08B69727E8097fCfd92

- 0x474F788b9778373B43E54Eff9430a2ddE7D44794

- 0x90d355c1446dF8b8882ec07eD76d016e8C53D5b8

- 0xFaf2807ee1AF93C5C61946De4Ffeb46D2D1D1743

- 0xf3C0e3c4d3A0B9f8acFAba58D5eAFd93ea72319e

- 0x9BcF4CE36e213438A05Eeb73AB70D34115abE686

- 0x06C1E757fe00781EB0E7eC5D11a3045C54d6993E

- 0x3231306F8248Be51CC0A9Bfc25765F174e0b1456

- 0x50a09e580EDEdB77Bb32953FD5E806746993A5B6

- 0x1341E576B476aA72EFF7ccdfe3694fC0EA6E7c32

- 0x144D27fD7AD545DA8C782145d2d903FFE3Bca312

- 0x6D38A1a9a9d65165F3AF52B0d3A72668Efc73d84

- 0x51DCf695074884710e2fD837fBE20A4e57D7A46C

- 0xc15F0a0C8d9F351Dcce026d506dD11A66DE1ebd4

- 0xcFDb22aAeBFA2E0C37b6f059C71d1366dC7CaC24

- 0xD730a85AacedEe3d917bf6F71bFadA4E5396Bf20

- 0x6e8dd4C366c6FDb73c28c73869d2954210A0cC99

- 0x61bb5517be43EC1AE9a66a4f5f7825F36D099CC5

- 0x8Cdd01C27d945B211f51bF716f927E0F986A9445

- 0x01beb6B0178e7b79C0F475F47E9E6Eb8cBCa750E

- 0x16095226748657EEc2C0645375D84383f09B4D8a

- 0x234BbC741b05298c9528eAC42f364ce53c53c13f

- 0xC47F4712BC191935f6475262076546461a0080ff

- 0x333B8BD64cE844F56ab7dD1E466ecd4572d007fC

- 0x046B29A07Bc690aD347dccC1320c42D220082fb6

- 0xb6D8E6f0b6ED0613BCd282e69c0BD650A5B09e17

- 0x90b98b43BCBCd813c57B401a987a6cBdF9BAdC2c

- 0x9262D82a8048C6BAEaB80bC000F66aECE7836cFB

- 0x5058E8b7a89d8Db2399856bEC032890053883C93

- 0x9AF1F785c7b1f6028DdE029FB02fA521daAc6c81

- 0xD08a3c8ec2dc2cC8c8E012c3Ae3ABf86Ad08C48E

- 0x0dC9c002F5D9AdCF9AB6D0cCF206CeDF75330C47

- 0x03f0dC9a210089FD4DC226858F0A7C2c9c2bEe33

- 0x0e90Be73B85CA57E94b8ff07Bb51b1869caE36EF

- 0xaaa836C83C981c2e7aAf224E6CA939e175457d93

- 0xF1220192A6F8567155Bad33Df049D3417d8efdB0

- 0x443d82ab580aa44d721b966022223c5412228Ab4

- 0x5650a53f13a2d05132D3029D2D1558F5bb6b5D70

- 0xd04264778741dAc90F828aD4ee3bfd7651002ddC

- 0x18E49A36Cb186FeD6AC7Bcec9f974E30662aC6e3

- 0xfae1d467B048D0Aaf8366427a099ed09891D7ea3

- 0x018265bbec0432E020C87e8c2e7D0aBf97C6894A

- 0xE341cFCED97Cb6B79f001dDEdFFe9F0a9A8569C6

Core Contributors - Wallets

- 0x756fC18Df7efFB81F69e85ea7D1790b17dc352E7

- 0x808fe627adA47E1FEe7c44a452Ad50aF21f244Cd

- 0x093D9D785792De7adc7bd4b696899ADd7b41B834

- 0x04aA5f83846928747c4DeC692cE3e95f6057D7cA

- 0xA5B947CA6770a3ac8425FBE9379e4C78814f7Ee9

- 0x676DBbD407e32Af424f74817898D732f8e2D6E03

- 0x793B8100B0ab58418FBE474Ab42942Cf0999Addd

- 0xAb5086dA364C5e72329fD5a0e8F7D7B70195dC21

- 0xb7fE5fd2a94aF9C711b3c2e0eD596B8ca9c04973

- 0xa5beab516CFD5BDbb97aeDD176cFE70B43f9b699

- 0xA5249e1FA84f38D14Cc38e8A4daA0746b1B94a05

- 0xF597dBc78EB89f7BE23eA8511aB276556037008e

- 0xCCAb30199abE1e721B531e92eDff62F72EaB1B8A

- 0xAd17ED22069a7cf52b933D1501719C74F2f08f2A

- 0x26D2c9D3252A819260Ff17C0BDf9F9b0954A901B

- 0x7482014Df222eD94CCa61b604EA54f6969B4c310

- 0xCe12d123bd77AEDaDb50A5178135148D9daA7701

- 0x49D61177c7700436C7a55A8aE048FA79eD50d80f

- 0xB518985e191BCA3b95B6e3bBA36b9f19150F52D1

- 0x0B7d4668C18455760E3538829e388A819E852dB0

- 0xfB86f9dE88B52Bc4116CE4CA6ABb16CCB91C7E95

- 0x6CB95eAa363cD5A80E1Ec2389A21224C00DBc36e

- 0x4A6725b5d20937D214Fbe14ebc22d21309dfBA5C

- 0x5471feE69e114B3B23891016aB4e848adF83AC91

- 0xcb979B3b58e59E483133d78E68E3E3229b56d76e

- 0xB735028389aD837ed1E528A172669B5B54f6D214

- 0xf03c830a85e0C0e5Ff9935CAAe867ae2CA4A2bA7

- 0xcBd786029645fB3b47B028057528547DDb0f2914

- 0x70546f34446Ce78CFD9Ed4d0A81f453023A40Ee0

- 0x0B966cF2CE8a7f6639D1dA73818df65D6AfA2Dac

- 0x4e28168e033b1601B31a0824879CDca79a2dB544

- 0x2315F27E3Ed871C4054aCf588C088435C3178aa8

- 0x9A6a79E5f92238A5b88E92e8C4439b3a1cdFa4B9

- 0x183Afccc88b9F08722570bF6BdB8c219E1eD2c73

- 0x3312Bc27dF7A4fdeC05F1489b1D09027638513E2

- 0x71967fE066F5A7C1094894d6886F14d46ACfeA4f

- 0x365cE96069529FeA0b9F6ada255Fed10aD6c89d8

- 0x25300fF42E6968024f52B0DB3EF33d8093cd95AC

- 0xEF5d0934474b90AC7BB46C12C09400d4cDE5B215

- 0x5b648b004236478C0134EB20fE31547Ae3Cd2F8b

- 0x4a1eD0a62292F4De878f2Ad78DcA31561B618D64

- 0xB5CE190D5C46Fa006A7C4573616b43D202B8B60d

- 0x20A2A6D91306633F783941a473d9f91bDeD1840E

- 0x64eaeD1Aa6B6A891EA48309cB663Fc26D88828D0

- 0xc075fd5fE1A07C6f2dCCED0896Ce3508f42a8CbC

- 0x5cFfD08820f7822e75A2Efa1A351D67A8b55E25C

- 0xa66D1998b0275548262DaCAf63286F6EB2Bea8df

- 0x943704119438c80E1bDb074504627342678b6DfC

- 0x419B5C01e9E5faC7589874b3f67463dE5Df60A75

- 0x1944F503794DB2Fb3273240fD6eC704b7C5d8A8B

- 0xC6d09Bb5384a0e0225362824C1Ad1206013A6537

- 0x1Fa74A2ebb5B40fd2c6Be03d110f11B5f5c1F4d4

- 0x63491b9208Bb71E5E723d49FdF68B7458E8495d3

- 0xB9bFdB88C9F4a3C091F050C5D34f63B5BDf2b916

- 0x5e15cfd58cB47651bc50a527801DFE407BDA8DFe

- 0xFF6bD610f76Ad2F6E4Ba1E27982BfaF98fa93656

- 0x1b1f4F9b1125D5D3Ac17A1f52dA13d6AbFa548C8

- 0x3bceaE8e9781B323af80b519d3B3D6Bf32C40217

- 0x56354bac7388df1A859F0F946f558a3371d54eDa

- 0x2706f47395FE5Fb28DcC48891680439B9027da20

- 0x6565688De62AB9D8FDC188651d63DCCe2eBc805C

- 0x8B3cF17Fb0FdbA37e71B2CF254124588F0bC2BCe

- 0xE2BC3b68b6879522a6d78878b7F0045931936967

- 0x4b78828A1186Dc162f4aA200be28BEC86F0E0B5D

- 0xa88a612245E1860b0f0414308aa60aF55fa018AF

- 0xd94586116EEE70bEbA7588961557ae455057f47F

- 0x3cA6c7E04e56aC291Ff8780E0EFf4783613C0F73

- 0xF613e6B4ea165a570C3f1743BE4FFB502d37001f

- 0x9B5BD3be2eBa0456429c58cE3Ad0B1719Ed3680d

- 0xDDa3e84d96E2E2F844caEff8827583300AAd7046

- 0xf0233c70F58CF516c906E6247806aa96a765Afcb

- 0xbdB1691Ae8fA2373a866E176f2B5c18aDdf87A13

- 0xb9440C482448927E88028ac99280FA3F4e385695

- 0x05784E5B54ecb0219b7cc7be8476A28751221045

- 0x0e859626Fb53c6aE2a508eBAC5BE94BFB4398D42

- 0x50706d55e7f7F6A816b04FC3993c90F57b9161Ea

- 0xD205f87Da76AE070fE1608526B61E96adE9a85f0

- 0x1A0E1F367505dF69E4f5daE02AdD4F3A1bd1C66A

- 0x805520D9DDCF8e0D977F0C63CaA43d304B199597

- 0xB60F908E9891f97E35A37baceC255465D9d55e32

- 0x8c6074da1c6a7CCCf75aDB8b908B452273599c4E

- 0x74cD8B4C5Ef6aDBAAab338bE450dc39d63e856C2

- 0xFF6bD610f76Ad2F6E4Ba1E27982BfaF98fa93656

- 0x86f10Ff80A4ADbF2EC31F4F0fA2189Ed904d7F21

- 0x4D0bFF1c89Baf6F0D3CDF7f99A83eb18e5167E9e

- 0x9DCD92C4E056f42A3F7815Dd6333a92a8295CDca

- 0xE25000A2034Bd25CC904B5139225513ceb58cE11

- 0x6BcDd0485cbAf0e64663ebcbd2A584a8Ce45Fdb5

Magic Labs - Wallets

- 0x2f870f3Bd8eD88F219ED8FDc8F9acFC3cf133AeB

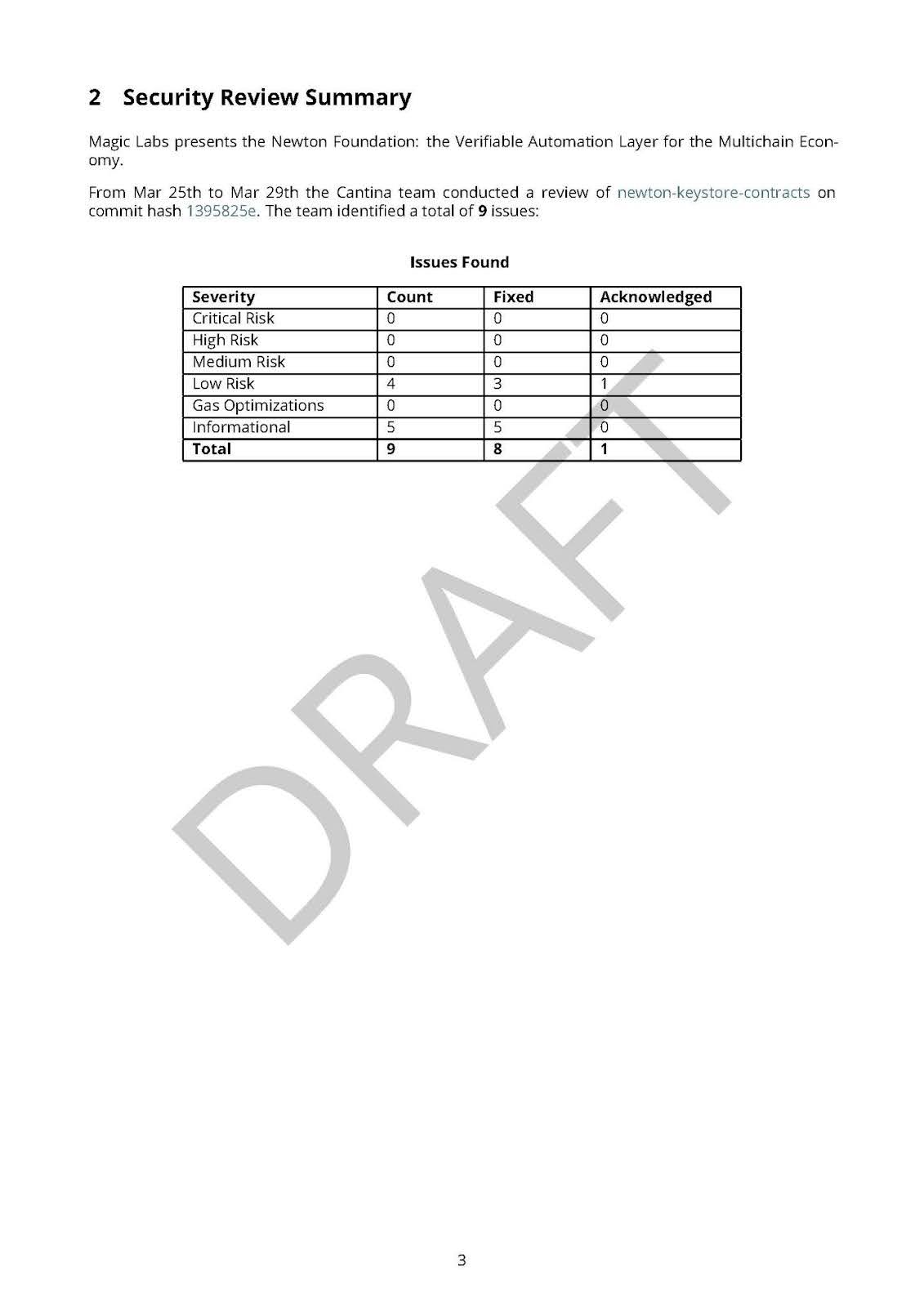

EXHIBIT B: AUDIT REPORTS AND CODE REPOSITORIES

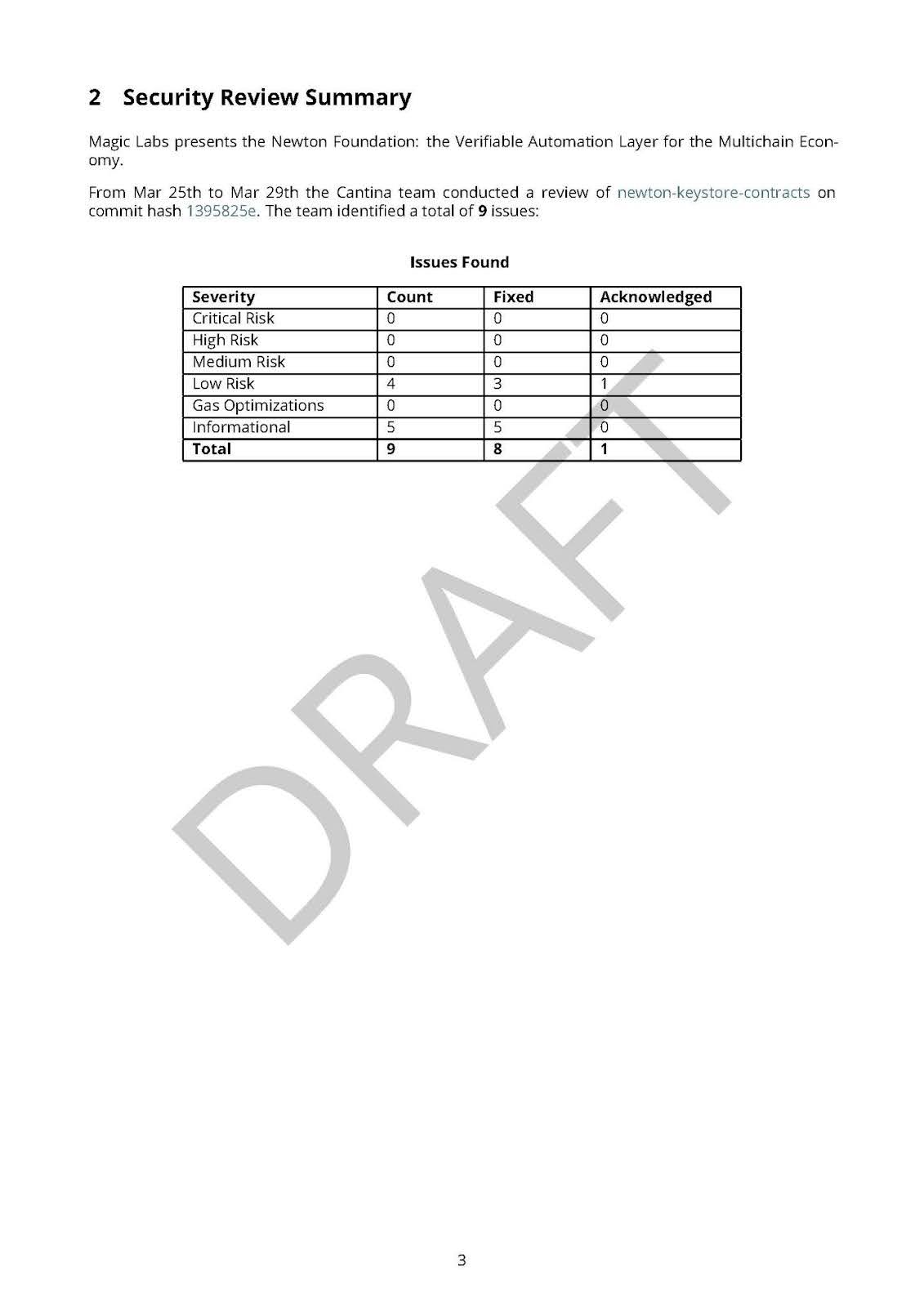

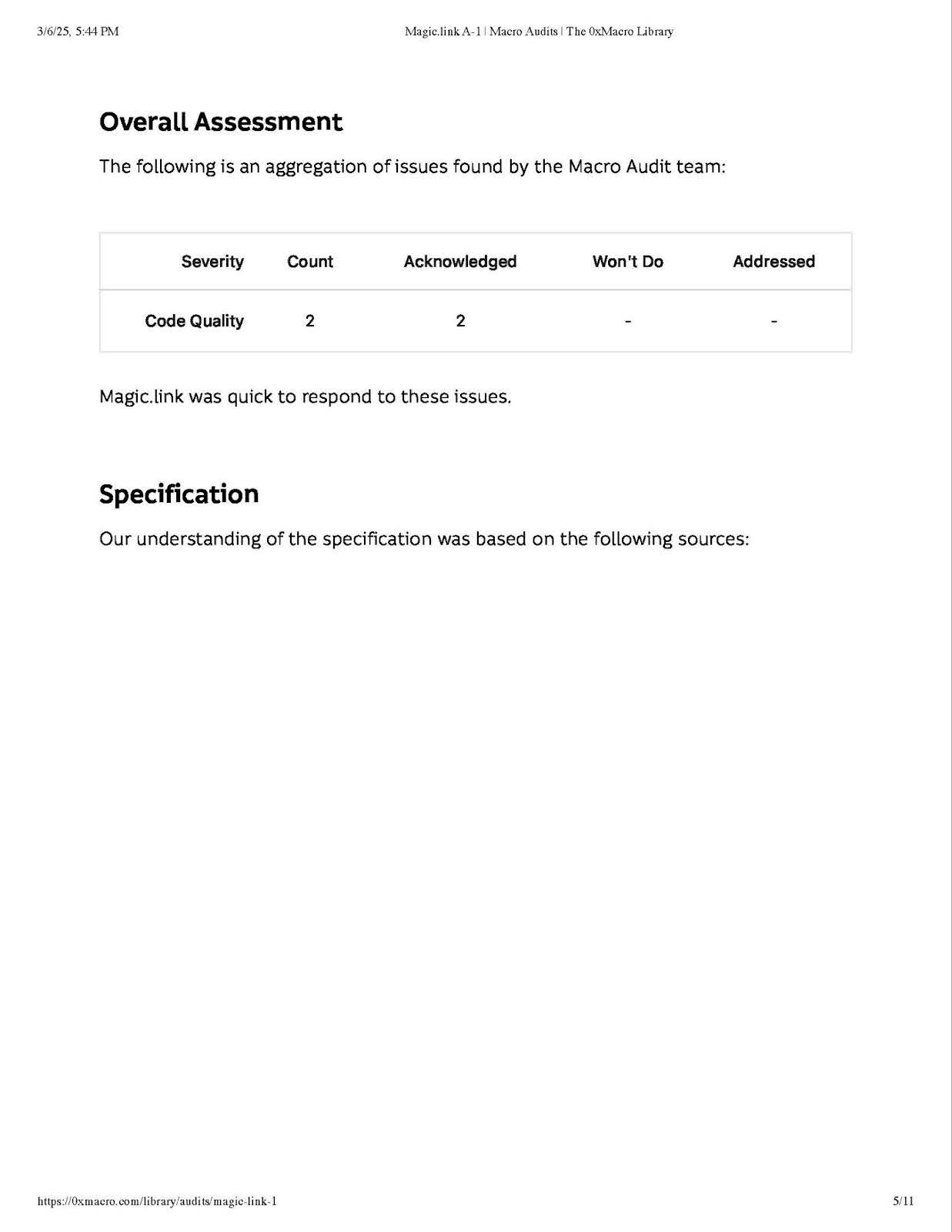

Token Smart Contract Audit Report

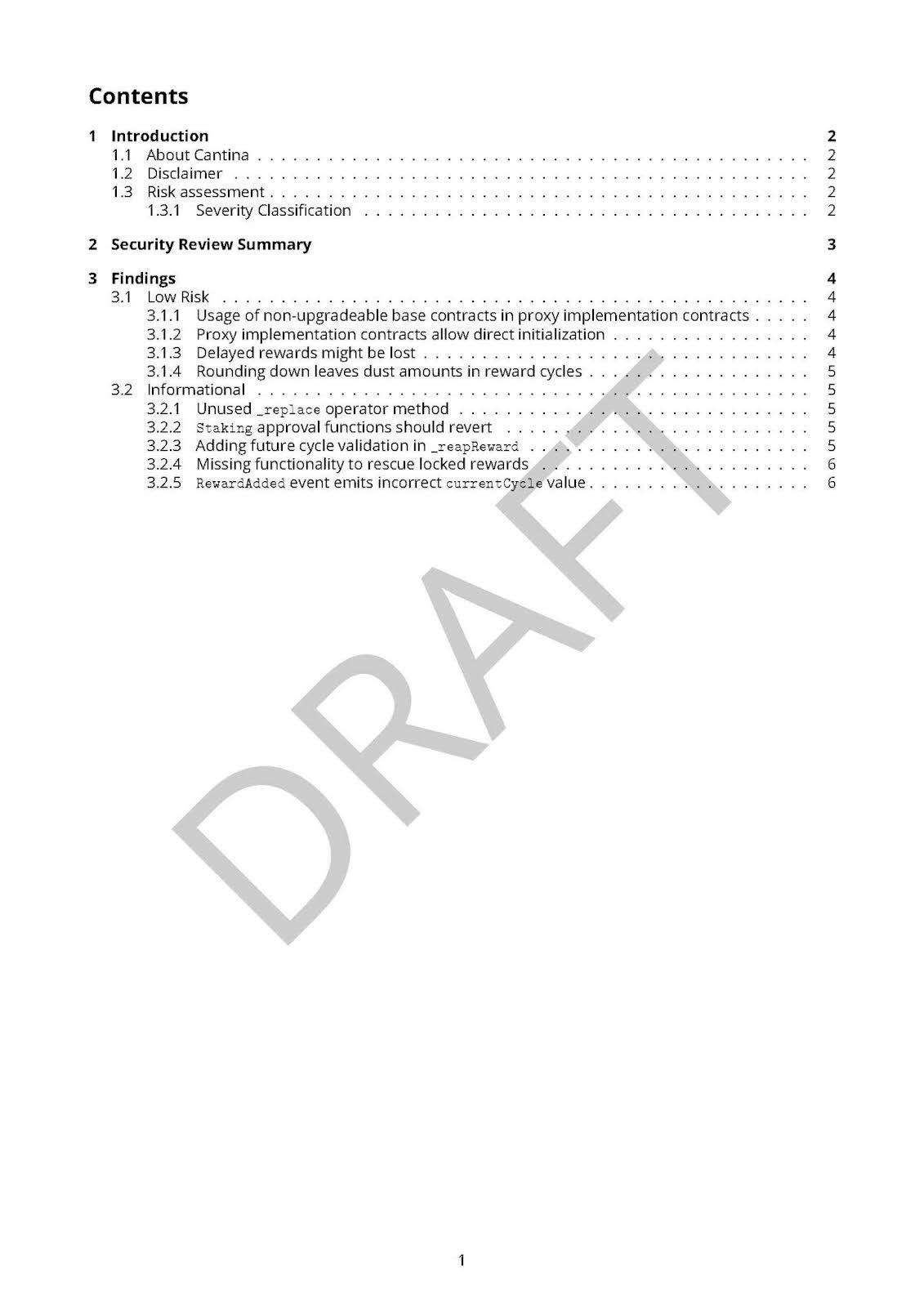

Staking & Airdrop Smart Contracts Audit Report

EXHIBIT C: LEGAL DISCLOSURES AND RISKS

Magic Newton Foundry Ltd. does not operate or control any centralized or decentralized trading venue on which NEWT tokens might be listed. The Protocol and its governance may evolve in response to technical or regulatory developments, and unforeseen risks could require changes to strategy or structure. The risks outlined below highlight regulatory uncertainty, liquidity limitations, governance risks, network centralization concerns, security vulnerabilities, and potential adjustments to fees or NEWT supply that could impact the holding of NEWT. It is critical that participants review these risks carefully. Additional MiCA disclosures can be found at: mica.newt.foundation.1. Regulatory and Legal Risks

- Jurisdictional Uncertainty: Regulations governing crypto-assets vary significantly by jurisdiction and are subject to rapid change. While Magic Newton Foundry Ltd. has taken steps to comply with applicable frameworks (including MiCA), future regulatory developments may impact NEWT’s classification, usage, or availability.

- MiCA and Other Frameworks: Compliance under MiCA does not guarantee compliance with other global frameworks. Participants remain responsible for complying with local laws, tax obligations, and reporting duties. To review the full MiCA whitepaper disclosure, please visit mica.newt.foundation.

- Enforcement and Classification Risk: NEWT is not intended to be any kind of security or investment, but regulatory agencies could decide to classify NEWT as a financial instrument or security, leading to compliance burdens, enforcement actions, or trading restrictions. In the United States, if NEWT were ever used in connection with derivatives or margin trading, the Commodity Futures Trading Commission (CFTC) could assert jurisdiction and require applicable compliance.

- Restrictions on U.S. Participation: Structured loan arrangements—including call-option liquidity—prohibit sale or marketing to U.S. Persons pursuant to Regulation S under the U.S. Securities Act of 1933. Borrowers must comply with applicable offshore transaction restrictions and ensure no directed selling efforts target U.S. markets.

- Anti-Money Laundering (AML), Counter-Terrorism Financing (CTF), and Sanctions: Authorities may scrutinize crypto-assets for potential links to illicit activity. Compliance with KYC, AML, and sanctions screening requirements may be required for certain transactions or platform access. Tokens or digital wallet addresses could become blocked, frozen, or specifically designated as restricted if the controller or any counterparties are the subject of any applicable sanctions regime.

- Taxation Risk: Participants must understand and comply with applicable tax obligations, which vary by jurisdiction and transaction type.

2. Holding Risks

- Volatility: As with other crypto-assets, the price of NEWT may experience significant fluctuations due to external factors such as shifting market sentiment, technological developments, and changes in regulatory environments.

- Liquidity Risk: There is no guarantee of deep or sustained liquidity on decentralized or centralized exchanges. Thin markets may result in slippage, failed transactions, or difficulty accessing or using NEWT.

- Risk of Delisting or CEX Insolvency: Listings are not guaranteed. Delisting or exchange insolvency could result in loss of access or tradability of NEWT.

- Valuation: Beyond stated Protocol utilities (governance, staking, gas, etc.), NEWT’s value is contingent on ecosystem growth, adoption, and community sentiment.

3. Technology and Infrastructure Risks

- Protocol Bugs and Smart Contract Failures: Despite audits and best practices, NEWT smart contracts and Newton Protocol may contain undiscovered bugs, vulnerabilities, or integration flaws.

- Private Key Loss: Holders are solely responsible for securing their wallet credentials. Lost keys result in permanent loss of access.

- Network Congestion or Downtime: Transaction delays, rising fees, or execution failures may occur during network stress.

- Immutability Risks: Some smart contracts are non-upgradable. Errors in deployed code may be irreparable.

- Quantum and Future-Tech Risks: Advances like quantum computing may pose long-term security risks to cryptographic primitives.

4. Governance and Economic Risks

- Fee and Supply Adjustments: While NEWT has a fixed supply, governance may vote to alter staking rewards, fee distributions, or other economic parameters.

- Internal Unlock Risks: certain NEWT genesis allocations are subject to 36-month vesting or 48-month unlock schedules (See Section 7: Token Distribution and Vesting). The vesting and unlocking of these tokens may influence the availability of NEWT.

- Operational Centralization (Transition Risk): The Protocol will initially operate under a centralized environment and permissioned validator model with eventual transition to a decentralized validator set. Centralization may pose censorship or governance risks during this phase.

- Consensus Failures: Network forks, validator failures, or governance disputes may disrupt protocol functionality or asset finality.

- Regulatory Driven Forks: Future regulatory requirements in certain jurisdictions could potentially compel validators or exchanges to support forked versions of the Protocol, potentially splitting liquidity and token value.

5. Counterparty and Ecosystem Risks

- Service Provider Dependencies: The Protocol depends on third-party infrastructure providers, including Intel TDX, RISC Zero, Succinct, and others. Failures, legal risks, or technical issues with these partners could affect the Protocol.

- Reputational and Fraud Risks: Unverified partners, scams, phishing, and impersonation risks may lead to loss of user funds or trust.

- Liquidity Arrangements: NEWT liquidity support involves call-option loan structures with third-party providers. While these arrangements aim to improve equitable token access, they carry the risk that counterparties may underperform or fail to meet their obligations, potentially leading to instability or reduced trust in the token. See Section 10: Financial Overview and Transparency for key terms related to these arrangements.

6. Implementation and Adoption Risks

- Technical Rollout Delays: Features such as staking, permissioned validator transitions, or governance upgrades may face delays.

- Adoption and Network Demand: The long-term utility of NEWT depends on ecosystem usage, developer participation, and agent-driven automation growth.

- Competitive Landscape: Other protocols may offer better incentives, tooling, or liquidity, challenging Newton Protocol’s position.

- Community Engagement: Sustained user and developer engagement is essential. Failure to build active community support may limit success.

- Insufficient Fee Revenue: The Protocol’s long-term sustainability depends on generating sufficient fee income to support validator rewards required for the ongoing security and functionality of the Protocol.

7. Unanticipated Risks

This disclosure is not exhaustive. There may be additional regulatory, economic, technical, or operational risks that are unforeseen at this time. Participants should conduct independent assessments before engaging with NEWT or Newton Protocol.EXHIBIT D: FINANCIAL POLICIES

Magic Newton Foundation Onchain Funds Usage Policy

Purpose and Scope This internal policy defines how Magic Newton Foundation (“Foundation”) is authorized to manage and utilize three designated on-chain token funds that are part of the Foundation’s token allocation. These funds – the Onchain Ecosystem Growth Fund, Onchain Ecosystem Development Fund, and the Onchain Foundation Treasury – collectively support the growth, development, and operations of the Newton Protocol ecosystem. This policy outlines the purpose of each fund, permitted uses and restrictions, governance oversight and requirements for transparency. While an internal document, this policy may be published for transparency and will guide both current fund usage and future adjustments as governance evolves. Scope: This policy applies to the Foundation’s Board of Directors and any Foundation teams or committees involved in budgeting, approving, or disbursing payments from the three on-chain funds. It covers the use of the specified token allocations (denominated in the Foundation’s native token, NEWT) comprising 15.5%, 12.5%, and 9.5% of total token supply respectively for the Growth Fund, Development Fund, and Treasury. All Foundation personnel must adhere to this policy when recommending or executing expenditures from these funds. Governance and Oversight Board Management: The Board of Magic Newton Foundation (“Board”) is responsible for the management and oversight of the Onchain Ecosystem Growth Fund, Onchain Ecosystem Development Fund, and Onchain Foundation Treasury. All decisions to deploy or allocate tokens from these funds must be approved by the Board in accordance with the Foundation’s governance procedures. The Board may delegate day-to-day administration (for example, reviewing grant proposals or processing payments) to Foundation staff or committees, but ultimate authority and responsibility remain with the Board. Expenditures from any fund shall follow internal approval workflows (e.g. documented proposals and Board resolution or committee sign-off) to ensure compliance with this policy and alignment with the Foundation’s mission. Community Participation Roadmap: The Foundation is committed to gradually introducing community participation in fund governance over time, as outlined in the project’s governance roadmap. Initially, the Board will exclusively manage these funds to ensure stability and accountability. Over time – and in alignment with decentralization milestones – the Foundation will implement mechanisms for token-holder or community input in funding decisions. This may include establishing community advisory boards, grant committees with community representatives, or on-chain governance votes for certain allocations. The shift to community-inclusive governance will be executed cautiously and transparently, ensuring that the community’s role expands according to a clear roadmap without compromising the effective use of funds. Until such mechanisms are in place, the Board retains final decision-making authority over all fund usage. Fund Allocations and Authorized Uses Below are the three on-chain funds covered by this policy, with their specific purpose, permitted uses, restrictions, and vesting schedules. Each fund represents a portion of the total NEWT token supply allocated to the Foundation’s initiatives. The funds must be used only for their intended purpose categories and in accordance with the restrictions noted. 1. Onchain Ecosystem Growth Fund (15.5% of total supply) Purpose: The Ecosystem Growth Fund is dedicated to campaigns, partners, and programs that directly grow the Newton Protocol ecosystem’s user base and engagement. This includes initiatives to attract, reward, and retain users and participants in the network. Any unclaimed or unused NEWT allocated to community rewards (e.g., airdrops) will remain unlocked and transferred to the Onchain Ecosystem Growth Fund for future use. Authorized Uses: The Growth Fund may be used to finance a variety of growth-oriented activities and incentives, for example:- User Acquisition Programs: Funding user onboarding and growth campaigns such as referral bonuses, airdrops, quests or challenges that reward new users for trying Newton Protocol-based applications.

- Staking and Participation Incentives: Budgeting for staking reward campaigns similar incentives that encourage users to stake tokens, provide liquidity, or otherwise actively participate in the Newton Protocol ecosystem.

- Marketing and Community Outreach: Paying for marketing efforts that increase awareness and adoption of Newton Protocol, including community events, workshops, educational content, ambassador programs, and strategic partnerships that drive user growth.

- Ecosystem Partnerships: Supporting collaborations with other platforms or communities (e.g. joint promotions or integrations) that bring new users into Newton Protocol ecosystem.

- Protocol Development: Providing grants or funding to core developers, ecosystem developers, or research groups working on improvements to Newton Protocol itself (e.g. Protocol upgrades, optimizations, security enhancements). This can include bounties for implementing new features or squashing critical bugs.

- Developer Bounties and Grants: Incentivizing external developers to build on Newton Protocol through hackathon prizes, bounty programs for creating dApps, tools, or integrations, and grants to open-source projects that benefit the Newton Protocol ecosystem (such as SDKs, libraries, or infrastructure components).

- Infrastructure Incentives: Supporting the growth of essential infrastructure by rewarding entities running nodes, validators, or other network infrastructure, or subsidizing services that improve network performance and reliability (for example, oracle services or layer-2 integrations specific to Newton Protocol).

- Technical Events and Education: Funding hackathons, developer workshops, coding bootcamps, and technical documentation or tutorials to educate and grow the pool of developers familiar with the Newton Protocol. Also includes sponsorship of developer conferences or Newton Protocol-centric meetups that spur technical collaboration.

- Security and Audits: Covering the costs of security audits, bug bounty programs, and expert reviews of Newton Protocol and related smart contracts to ensure a secure and robust ecosystem.

- Personnel and Staffing: Funding salaries, benefits, and contractor payments for Foundation staff who work on legal, operational, regulatory, administrative, marketing, or any non-core-development roles. This includes hiring new staff and related recruitment expenses, as well as board stipends if applicable.

- Operational Expenses: Paying for day-to-day operational costs such as office space, software subscriptions, cloud services, equipment, and other overhead required for the Foundation’s functioning. This also covers expenses like accounting and bookkeeping services, insurance, and other corporate requirements.

- Vendor and Service Provider Payments: Settling invoices from external vendors or service providers engaged by the Foundation – for example, legal counsel, accounting firms, auditors, compliance consultants, or public relations agencies. Any professional services procured to support the Foundation’s mission or in support of Newton Protocol can be paid from the Treasury.

- Foundation Governance and Initiatives: Funding the execution of Foundation-led programs that are not directly user-facing but necessary for ecosystem health, such as research initiatives, policy and governance development, or cross-ecosystem collaborations.

- Quarterly Fund Usage Reports: The Foundation will publish quarterly reports detailing the expenditures from each of the three onchain funds. These reports will include a summary of how many tokens (or their fiat equivalent value if held in offchain accounts) were spent from each fund in the quarter, for what general purpose, and under which category (growth, development, or treasury). The report should highlight major initiatives or grants given, and it will include the remaining token balances of each fund. Reports will be published on an official Foundation channel (e.g. the Foundation’s blog or website) after Board review. They will omit any confidential counterparty details as necessary (for instance, individual salaries might be aggregated for privacy), but will aim to provide the community with a clear view of fund utilization.

- On-Chain Wallet Transparency: The Foundation will maintain dedicated on-chain wallet addresses for each of the three funds (segregated for Growth, Development, and Treasury). These addresses will be made publicly accessible and labeled, so that community members or third-parties can independently track fund balances and token movements onchain. Any tokens (or proceeds from their sale) that are not held in onchain tagged wallets will be disclosed by Foundation as part of its quarterly disclosure reports. All disbursements from these wallets should be made from the designated addresses to ensure traceability.

- Compliance: Internally, detailed records of fund usage will be kept to demonstrate compliance with this policy. The Foundation’s finance team will ensure that use of funds aligns with this policy. Additionally, the Board may commission periodic independent third-party verification of the fund activity to reinforce trust and accountability.

- Applicable Policies: All public disclosures will be made in compliance with applicable legal, regulatory, and policy requirements. For example, if certain financial information is sensitive or subject to privacy laws, the Foundation will still report in aggregate while respecting those constraints. The commitment to transparency operates within the bounds of any confidentiality obligations, but the default expectation is to be as open as possible about fund use. In case of any conflict between this policy’s transparency mandate and other policies (e.g. privacy or legal compliance), the Board will seek a balanced solution, erring on the side of accountability to the community.

- Amendment Process: Any changes to this policy must be proposed and approved through a formal Board resolution. Material amendments (for example, repurposing a fund or altering its use cases) should be clearly documented. When amendments are made, the Foundation will communicate these changes internally to all relevant team members. If the policy is published publicly, the Foundation will also update the public documentation and, if appropriate, notify the community of the change (especially if it affects how funds might be used or overseen in the future).

- Community Input on Amendments: As the governance of the funds opens up to community participation (per the roadmap mentioned above), the Board may also seek input from the community on proposed policy changes. While the Board has final authority to amend this document, incorporating community feedback can improve legitimacy and alignment with stakeholder expectations. Future iterations of this policy might even require a token-holder vote or community council review to ratify major changes, once such governance structures are in place.

Magic Newton Foundation Insider Trading Policy

- Overview. This Trading Policy (the “Policy”) establishes guidelines to prevent improper trading in Digital Assets (as defined below) and to ensure compliance with applicable laws and regulations. This Policy applies to all Covered Persons of Magic Newton Foundation and its subsidiaries (collectively, the “Foundation”) and is designed to mitigate risks related to Material Nonpublic Information, conflicts of interest, and market integrity.

- Covered Persons. This Policy applies to all directors, officers, and employees of the Foundation, as well to all contractors, clients, and counterparties of the Foundation who have adhered to this Policy separately in writing (collectively, “Covered Persons”). Covered Persons include members of their immediate families and members of their households.

- Digital Assets. This Policy applies to the trading of Newton (NEWT) and any other digital assets, including but not limited to cryptocurrencies, stablecoins, tokens, and non-fungible tokens (NFTs), regardless of whether they are fungible or unique (collectively, the “Digital Assets”).

- Covered Transactions. This Policy applies to all transactions involving Digital Assets, which include acquisitions, purchases, lending, borrowing, disposals, sales, short sales, derivatives, hedging, hypothecation, pre-arranged trades, and any other forms of agreements, contracts, or transactions that are intended to provide economic exposure to Digital Assets (collectively, “Covered Transactions”).

- Material Nonpublic Information. It is not possible to define all categories of material nonpublic information. However, information should be regarded as “Material Nonpublic Information” concerning a single or several Digital Assets if: (a) such information has not been previously disclosed to the general public and is otherwise not available to the general public, and (b) it is reasonably likely to be considered important by a person when determining whether to buy, sell, or otherwise transact in a Digital Asset. While it may be difficult to determine whether certain information is Material Nonpublic Information, there are various categories of information that are particularly sensitive and more likely to be Material Nonpublic Information. Examples of such information may include:

- an actual, pending, or contemplated Foundation Covered Transaction or series of Covered Transactions involving a Digital Asset(s), particularly where such transactions are of significant value;

- integrating or leveraging of Digital Asset(s) or related software or infrastructure, or any pending announcement regarding the same;

- partnership, association with, or entering an agreement between the Foundation and any exchange, on-ramp service, or any other company that may affect price or usage of Digital Assets;

- decision of the Foundation to discontinue development of a products, or to stop accepting, transacting with, or supporting any Digital Asset;

- decision of the Foundation to develop any software related to a Digital Asset when said software is reasonably expected to affect the price or usage of the Digital Asset.

- No Trading of Digital Assets When in Possession of Material Nonpublic Information. Regardless of the existence (or not) of a Non-Trading Period, a Covered Person possessing Material Nonpublic Information relating to a particular Digital Asset, will not engage in any transaction involving such Digital Asset on the basis of that information from the moment when a Covered Person becomes aware of Material Nonpublic Information until the information is considered to have been publicly disclosed, or in the absence of public disclosure, when the information is no longer material. Material Nonpublic Information is considered to have been publicly disclosed only after it has been widely disseminated.

- Non-Trading Period. A non-trading period is any time period designated by the Compliance Officer during which Covered Persons may not, as a general rule, engage in a transaction involving Digital Assets (“Non-Trading Period”). The Compliance Officer will impose a Non-Trading Period (a) whenever the Foundation is conducting one or more Covered Transactions, (b) there is likely to be Material Nonpublic Information as defined in Section 5, or (c) in other circumstances at the discretion of the Compliance Officer.

- No Disclosure or Tipping of Material Nonpublic Information. If a Covered Person discloses or tips an outsider (“Tippee”), using Material Nonpublic Information, and the Tippee undertakes a trade in Digital Asset, both the Covered Person and the Tippee may be found liable. A Covered Person will not disclose (“tip”) all or any portion of Material Nonpublic Information to any Tippee where such Material Nonpublic Information may be used by a Tippee to profit by trading in a transaction involving Digital Asset (any such action, “Tipping”).

- Adverse Conduct and Market Manipulation. Covered Persons must not engage in any activity that is adverse to, or that has the appearance of being adverse to, the interests of the Foundation in connection with any transaction involving Digital Assets. This includes, but is not limited to, market manipulation, deceptive practices, or any conduct that creates or induces a false, misleading, or artificial appearance of activity or value in any Digital Asset.

- Front-running – Executing, facilitating, or participating in transactions based on Material Nonpublic Information before it is publicly available.

- Wash trading – Engaging in or facilitating trades that result in no material change in beneficial ownership of a Digital Asset, including self-trading or coordinated trading with others.

- Pump-and-dump schemes – Coordinating or engaging in manipulative activities designed to artificially inflate or deflate the price of a Digital Asset for personal or third-party gain.

- Spoofing or layering – Placing and canceling orders to create false signals of supply or demand.

- Ramping or cornering – Manipulating the price, value, or trading volume of a Digital Asset or any related instruments to create artificial scarcity, demand, or market dominance.

- Tipping – Disclosing or sharing Material Nonpublic Information with any person or entity who may use it to transact in Digital Assets.

- Social media manipulation – Coordinating or engaging in deceptive conduct intended to unduly influence the market price of any Digital Asset through social media or other public forums.

- Aiding or abetting – Facilitating, assisting, financing, supporting, or endorsing any of the foregoing activities in any capacity.

- Use of rarity ranking tools – Utilizing rarity or sniping or any similar tools in connection with any Digital Asset, product, or project by or in collaboration with the Foundation.

- Due to their role at the Foundation – Covered Persons may not accept any allocation, preferential treatment, or special access to Digital Assets based on their affiliation with the Foundation.

- For internal Foundation products or tokens – Covered Persons may not participate in any whitelist, airdrop, or similar distribution related to Digital Assets issued, supported, or promoted by the Foundation (which for clarity, includes NEWT).

- Comply with the Policy – All provisions of the Policy related to the handling, disclosure, and trading of Digital Assets apply to these assets.

- Not sell or transfer for value – Covered Persons must not sell, trade, or otherwise disburse Digital Assets received through whitelists or airdrops if the value of those assets is influenced by the Covered Person’s role at the Foundation.

- Individual Responsibility. Each Covered Person has an individual responsibility to comply with this Policy and applicable laws against insider trading, regardless of whether a Non-Trading Period is in place. Appropriate judgment should always be exercised in connection with any transaction involving Digital Assets. At any time and from time to time, a Covered Person may have to forego a proposed transaction involving Digital Assets even if they planned to make the transaction before learning of Material Nonpublic Information, and even though the Covered Person may suffer an economic loss or forego anticipated profit by waiting until the Non-Trading Period ends. Covered Persons must cancel all stop-loss orders and other open or limit orders in Digital Assets during Non-Trading Periods to avoid the possibility of transactions that may violate applicable laws or this Policy.

- Contractors. This Policy applies to such third-party contractors, clients, and counterparties of the Foundation, who have accepted this Policy by entering a written agreement with the Foundation that expressly refers to this Policy.

- Compliance Officer. The Foundation’s legal counsel or other designated individual (“Compliance Officer”) is responsible for the implementation of this Policy. Unless otherwise stated, the Compliance Officer has authority to make all decisions and determinations under this Policy.

- Questions About this Policy. If any questions arise with respect to the application of this Policy, before you engage in a transaction involving Digital Asset, ask a Compliance Officer.

- Reporting Violations. Covered Persons have an obligation to report known or suspected violations of this Policy to the Compliance Officer in an expeditious manner.

- Consequences of Non-compliance with this Policy. Covered Persons who violate any portion of this Policy are subject to disciplinary action by the Foundation, which may include termination of employment depending on the circumstances as determined by the Foundation in its discretion. Covered Persons may also be subject to criminal or civil liability for violating applicable laws or regulations.